WhiteBIT Exchange Review 2025: Honest User Insights on Fees, Features, and Performance

If you’ve been comparing crypto exchanges, you’ve probably seen WhiteBIT pop up on a few recommendation lists. I spent a couple of weeks trading on it to see if it really holds up against big names like Binance or KuCoin. This WhiteBIT Exchange Review is simply my honest take—what feels smooth, what feels lacking, and whether I’d actually keep using it in 2025.

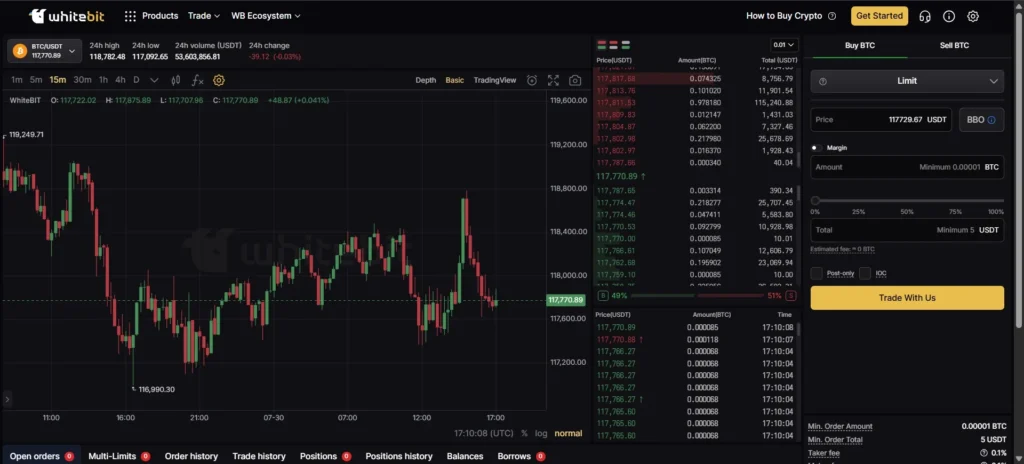

WhiteBIT Exchange Review – First Experience Using the Platform

Credit From: blog.whitebit

Getting started on WhiteBIT was straightforward. I signed up using my email, did a quick KYC check, and within a few hours, my account was fully active. The interface is surprisingly clean—no overloaded dashboards or confusing menus. For beginners, this is a big plus because you can find your way around without spending hours watching tutorials.

Order execution was quick during my first BTC/USDT trades. Even when the market was moving fast, my limit orders filled without delays. It gave me a sense that liquidity here is decent for major coins, even if it’s not as deep as the biggest global exchanges.

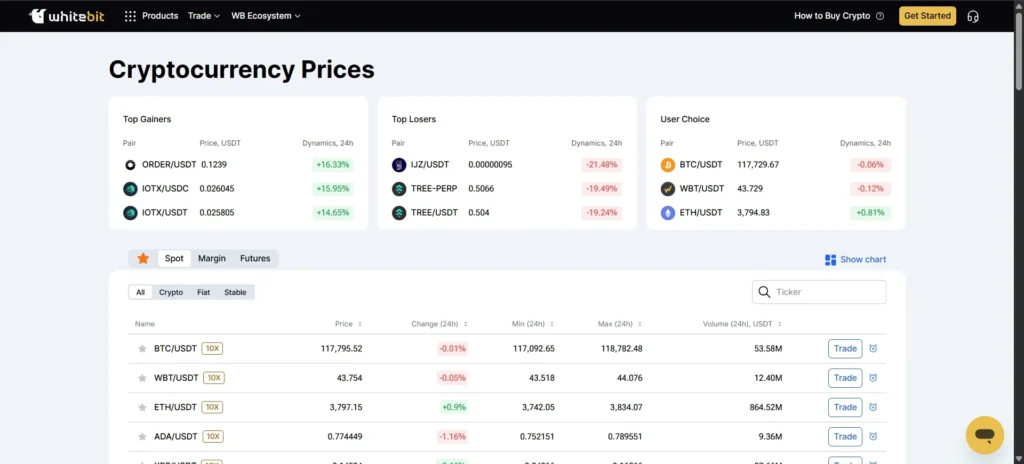

Features That Stand Out on WhiteBIT Exchange

Credit From: blog.whitebit

WhiteBIT supports over 270 cryptocurrencies, so most popular coins are available. The spot market feels stable, and the futures section gives you moderate leverage if you’re comfortable with higher-risk trades.

The mobile app is solid. I’ve tested it on both Wi-Fi and mobile data, and it doesn’t lag or freeze. You can set stop-limit orders, check balances, or make quick trades without needing to be in front of your computer. It’s not overloaded with fancy analytics, but it does the essentials well.

WhiteBIT Exchange Review – Understanding the Fees

Credit From: blog.whitebit

Fees are where WhiteBIT really shines. Most of my trades were charged around 0.1%, which is already low. The platform uses a tiered system where high-volume traders get even better rates. Here’s a quick look at how fees drop as you trade more:

| Level | Maker Fee | Taker Fee |

|---|---|---|

| Level 1 | 0.0100% | 0.0550% |

| Level 2 | 0.0060% | 0.0540% |

| Level 3 | 0.0040% | 0.0535% |

| Level 4 | 0.0030% | 0.0530% |

| Level 5 | 0.0020% | 0.0525% |

| Level 6+ | 0.0010% → 0.0000% | 0.0520% → 0.0350% |

Deposits are free for most coins, and withdrawals were reasonably priced compared to other exchanges I’ve tried. I moved out some USDT and it cleared within minutes.

Security and Trust Factor

Whenever I try a new exchange, I pay close attention to how it handles security. WhiteBIT uses two-factor authentication for logins and withdrawals, and they say 96% of funds are in cold storage. I didn’t face any issues with frozen funds or strange delays.

While no exchange is bulletproof, the track record so far seems clean—no major hacks reported publicly. That’s reassuring, especially if you plan to keep funds there for more than just quick trades.

The Ups and Downs of Using WhiteBIT

| Pros | Cons |

|---|---|

| Low trading fees and volume-based discounts | Not as many advanced tools as top-tier exchanges |

| Quick sign-up and easy navigation | Liquidity is thinner on lesser-known tokens |

| Mobile app is fast and stable | Fiat withdrawal options depend on your region |

| Strong security measures | Not available in every country |

Most of the downsides won’t bother casual traders. If you’re trading big volumes on niche coins or need advanced charting tools, you might feel limited. Otherwise, it covers the basics really well.

Is WhiteBIT Worth Using in 2025?

This WhiteBIT Exchange Review comes down to one thing: it’s a simple, low-fee exchange that gets the job done. It’s not trying to be the flashiest or the most complex platform. If you value quick execution, fair fees, and a clean interface, you’ll probably like it.

For traders who need in-depth analytics or high leverage, pairing WhiteBIT with another platform could make sense. But as a daily go-to for spot trading, WhiteBIT feels safe, reliable, and worth keeping on your list in 2025.